U.S. Targets China’s Chip Industry; China Counters with Rare Mineral Ban

The technology rivalry between the United States and China has escalated into a full-blown economic standoff, with both nations deploying powerful tools to safeguard their interests. The U.S. has imposed strict controls on advanced chip exports to China, aiming to curb its technological and military advancements. In retaliation, China has struck back by banning the export of critical rare minerals—gallium, germanium, and antimony—essential for chip production and high-tech industries.

What does this mean for the future of global technology and supply chains? The stakes are higher than ever, with ripple effects likely to shape industries and geopolitics worldwide. Let’s dive deeper into how this high-stakes conflict unfolded, what each side hopes to achieve, and the broader implications of this tech war.

The U.S. Tightens Rules on China’s Chip Industry

The U.S. has been increasing its efforts to slow China’s technological rise, particularly in the semiconductor industry. Earlier this month, the Biden administration announced stricter export controls, limiting China’s access to advanced AI-related chips and equipment needed to produce cutting-edge semiconductors.

These restrictions target key players in China’s tech ecosystem, including major companies like Naura Technology Group, Piotech, ACM Research, and SiCarrier Technology. The U.S. is also set to impose further restrictions on Semiconductor Manufacturing International Co. (SMIC), China’s largest contract chip manufacturer. The Commerce Department has placed 140 Chinese groups on the “entity list,” a blacklist that prevents U.S. suppliers from shipping to them unless they obtain a special license. These license requests are typically denied.

The measures include restrictions on 24 new types of chipmaking tools, three software tools, and high-bandwidth memory (HBM) chips critical for AI and advanced computing. A key part of this strategy is the Foreign Direct Product Rule (FDPR), which allows the U.S. to block sales of products made with American technology, even if produced abroad. Exemptions for allies such as Japan and the Netherlands are contributing to a coordinated effort to counter China’s technological ambitions.

U.S. officials argue that restricting China’s access to these technologies is necessary to maintain national security and technological dominance. Meanwhile, Chinese industry groups have called for greater reliance on domestically produced semiconductors, arguing that U.S. chips are no longer safe or reliable.

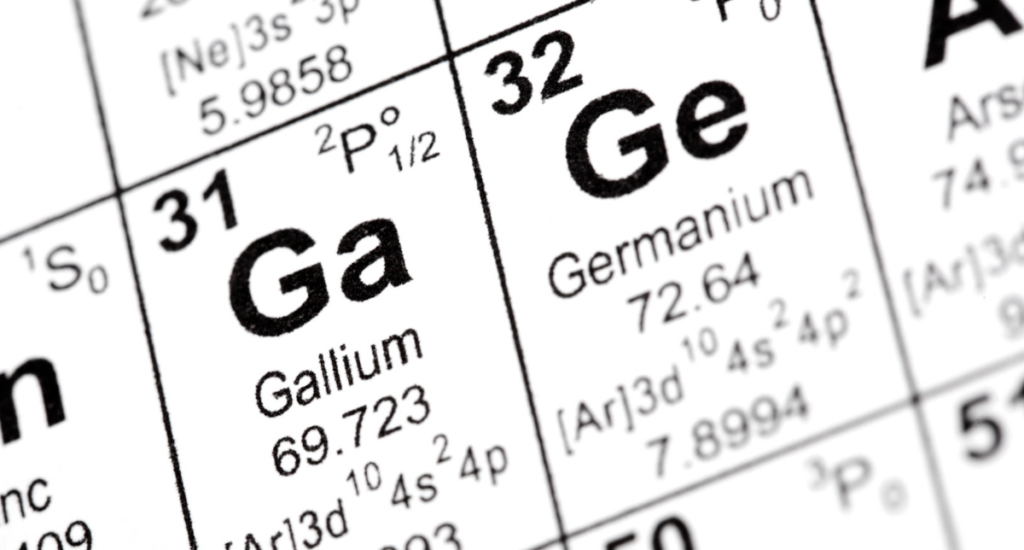

China Hits Back: Rare Minerals Export Ban

In a bold countermeasure, China has announced a ban on the export of gallium, germanium, and antimony to the United States. These minerals are crucial for producing semiconductors, solar panels, electric vehicles, and military equipment. Gallium, for example, is vital for high-speed electronics, LED technology, and advanced automotive systems. Germanium plays a key role in fiber optics, infrared imaging, and solar cells. Antimony is used in batteries, flame retardants, and military applications such as night-vision goggles and artillery shells.

China dominates global production of these materials, accounting for 94% of the world’s gallium and 83% of its germanium. The U.S. imports around half of its gallium and germanium directly from China, although it also sources them from countries like Canada, Germany, and Japan. However, since China began tightening restrictions on these exports last year, prices have risen sharply in the global market.

By halting exports to the U.S., China is seeking to disrupt American supply chains, creating a bottleneck that could increase costs for U.S. companies and delay the production of critical technologies. While alternative sources like Canada and Australia may be able to step in, it would take years to scale up production to meet demand. This gives China significant leverage in this high-stakes confrontation, with the potential to cost the U.S. billions of dollars.

Global Implications of U.S.-China Tensions

The growing tensions between the U.S. and China are having far-reaching consequences that extend well beyond their borders. Here are some key impacts:

The back-and-forth restrictions could lead to significant supply chain disruptions and inflationary pressures, particularly for third-party countries. Global industries that rely on semiconductors may face higher costs as export controls drive up prices.

U.S. companies are preparing for increased costs as they seek new suppliers for rare minerals. Sectors such as electronics, defense, and clean energy could experience delays and price hikes, potentially costing billions of dollars. While China dominates the global supply of these minerals, the U.S. does have alternatives—other countries produce these materials, and efforts to ramp up non-Chinese production could provide some relief in the long term.

What’s Next?

The U.S. is expected to intensify efforts to reduce its reliance on Chinese resources. This could include boosting domestic mining of rare minerals, increasing the recycling of electronic waste, and investing in research to develop alternatives to materials like gallium and germanium. However, these initiatives may not fully address the immediate disruptions caused by China’s export ban.

On the other hand, China is leveraging its control over rare minerals as a powerful bargaining chip in the ongoing tech war. By targeting a critical weakness in the U.S. supply chain, China is sending a clear message about its ability to retaliate against sanctions, strengthening its position in this economic rivalry.

Conclusion

The U.S.-China tech war is changing global trade, technology, and innovation. What started with restrictions on semiconductor exports has now expanded to include critical minerals, as both countries try to secure their place as leaders in technology. This conflict isn’t just about chips or rare minerals—it’s about gaining control over the future of technology, economic power, and global influence.

The effects of this tech war will be felt around the world. Industries that rely on semiconductors and rare minerals will face disruptions, and governments and companies will need to adapt to a more uncertain and divided technological environment.